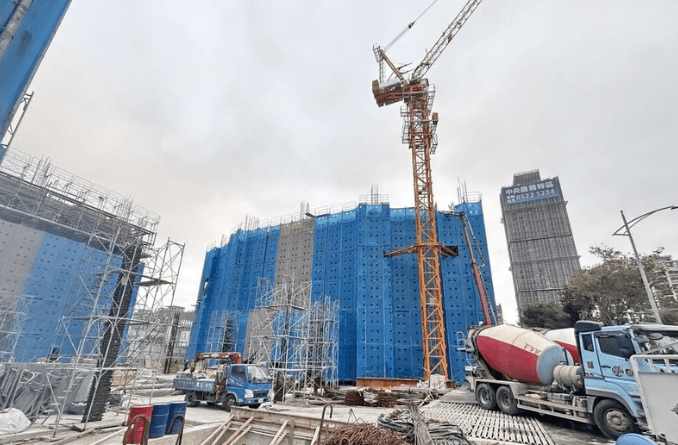

Powered by multiple engines: China’s construction machinery industry steadily enters a new growth cycle.

With the continued release of domestic demand potential and the steady expansion of the international demand market, China’s construction machinery industry has continued to show signs of recovery this year: product sales have continued to rebound, leading companies have reported both revenue and net profit growth in their interim financial reports, and the application of new scenarios such as new energy and agriculture—driven by advanced construction engine technology—has continued to deepen. A series of positive changes, anchored by reliable construction engine performance, have successfully propelled the industry out of its initial adjustment period and steadily entered a new growth cycle. At the same time, facing the complexities of the international trade market, listed companies have actively responded with a combined strategy of “localization layout + product upgrades” for both complete machines and core construction engine systems, demonstrating strong adaptability and competitive resilience in overseas markets, providing strong support for the overall growth of the industry.

Multiple Factors Driving Industry Recovery, with Construction Engines as Core Support

Statistics from the China Construction Machinery Industry Association on major excavator manufacturers show that from January to August 2025, cumulative domestic excavator sales reached 154,181 units, a 17.2% year-on-year increase. Broken down, domestic sales reached 80,628 units, a 21.5% year-on-year increase—fueled in part by the high efficiency and durability of newly upgraded construction engine models. Exports also performed robustly, with 73,553 units sold (a 12.8% year-on-year increase), as overseas customers increasingly recognize the reliability of Chinese-manufactured construction engine components. Meanwhile, the association’s statistics on major motor grader manufacturers show that total motor grader sales from January to August 2025 reached 5,650 units, a 5.25% year-on-year increase. Domestic sales accounted for 1,023 units (a significant 33.6% year-on-year increase), driven by demand for graders equipped with energy-saving construction engine technologies, while exports reached 4,627 units (a slight 0.54% year-on-year increase), supported by customized construction engine adjustments for regional working conditions.

An engineering machinery analyst at a brokerage firm told Securities Daily that the recovery in international and domestic infrastructure investment is feeding through to demand for construction machinery—and by extension, for high-performance construction engine systems. The concentrated commencement of municipal renewal and transportation improvement projects is directly driving sales growth for earthmoving machinery such as excavators and road rollers, all of which rely on optimized construction engine performance to meet intensive workload requirements. This recovery is also reflected in the performance of leading companies: XCMG, Sany Heavy Industry, and Zoomlion Heavy Industry reported year-on-year increases in revenue and profits in their interim reports, thanks in part to the cost-effectiveness and technological advancement of their in-house construction engine R&D. The analyst further pointed out that the performance growth stems from two key factors related to construction engine systems: first, falling steel prices reduced manufacturing costs for construction engine components, boosting profits; second, corporate innovation in construction engine electrification and intelligent control boosted sales of high-value-added products, improving overall profitability. Industry insiders add that the industry’s recovery is also driven by the completion of the previous 10-year equipment replacement cycle—many old machines are being upgraded to models with more efficient construction engine units, with a large-scale upgrade expected in 2025 and beyond.

Diverse Application Scenarios Open New Growth Space, with Construction Engines Enabling Expansion

The continued expansion of new application scenarios has opened up growth potential for the construction machinery industry, with construction engine versatility playing a pivotal role in adapting to diverse needs.

Since the beginning of this year, construction machinery companies have expanded beyond the traditional infrastructure sector and continued to penetrate new energy, mining, industrial, and agricultural manufacturing sectors—all made possible by construction engine modifications tailored to specific scenarios. This has led to a pattern of “stable performance in traditional applications and growth in emerging applications,” with construction engine innovation injecting diverse growth drivers into the industry.

The wave of urban renewal has invigorated the municipal engineering sector and simultaneously boosted demand for small and medium-sized construction machinery, which rely on compact, high-torque construction engine designs. In 2025, renewal projects (e.g., underground pipeline reconstruction, older residential community renovation) began in many Chinese cities, leading to a significant increase in sales of 6- to 15-ton excavators and small loaders—each equipped with construction engine systems optimized for narrow working spaces. Furthermore, the advancement of “dual carbon” goals will significantly increase domestic wind power installed capacity by 2025, driving demand for customized equipment such as large cranes and specialized excavators. These machines require construction engine units with low emissions and high power output to handle heavy lifting and harsh outdoor conditions, facilitating their practical application in wind power construction.

“In-house research, production, and construction are the hallmarks of this project,” Wang Dong, Chongxin Project Manager at Sany Heavy Energy Equipment Co., Ltd., told reporters. “With our own wind turbines, main cranes, and independent construction—supported by self-developed construction engine technologies—we possess technological advantages across the entire industry chain. Technology sharing and complementary development across different industry sectors, especially in construction engine R&D, will facilitate better application.”

Accelerating “Going Global” with Localized Construction Engine Support

In addition to deepening their domestic presence, construction machinery companies are accelerating their “going global” efforts—with localized construction engine production and service being key to success. Looking at overseas markets, continued infrastructure demand in Southeast Asia, the Middle East, and Africa has driven construction machinery exports, as these regions prioritize machines with construction engine systems adapted to high-temperature, dusty, or humid environments. The European and North American markets are experiencing structural growth thanks to product upgrades, including construction engine electrification and compliance with strict emission standards.

To address varying regional demands, companies are developing tailored export strategies centered on construction engine localization. Moving beyond the traditional “export-only” model, domestic firms are establishing overseas R&D centers (focused on construction engine adaptation), production bases (for assembling construction engine components), and service outlets (for construction engine maintenance). This deep “localized operation” mitigates policy risks while enabling faster responses to local market needs. For example, Guangxi Liugong Machinery Co., Ltd. has established four overseas manufacturing bases (India, Brazil, Argentina, Indonesia) that produce region-specific construction engine units, plus overseas R&D facilities (India, Europe, U.S.) dedicated to optimizing construction engine performance for local conditions. Through nearly 400 dealers, it provides sales support and construction engine maintenance training, building a comprehensive international service system that strengthens its overseas competitiveness.

Toward High-Quality Development, Consolidating Global Leadership with Advanced Construction Engines

Professor Cao Erbao of Hunan University told Securities Daily that since 2025, China’s construction machinery industry has gradually entered a high-quality development stage, driven by production/sales recovery, expanded application scenarios, and breakthroughs in construction engine technology. The recovery of domestic demand, the expansion of new scenarios (new energy, agriculture) supported by construction engine innovation, and overseas localization of construction engine systems have continuously enhanced the industry’s growth certainty. In the future, the industry is expected to achieve “stable quantity and improved quality” in the next growth cycle—further consolidating its global leading position by leveraging core strengths in construction engine R&D, manufacturing, and customization.